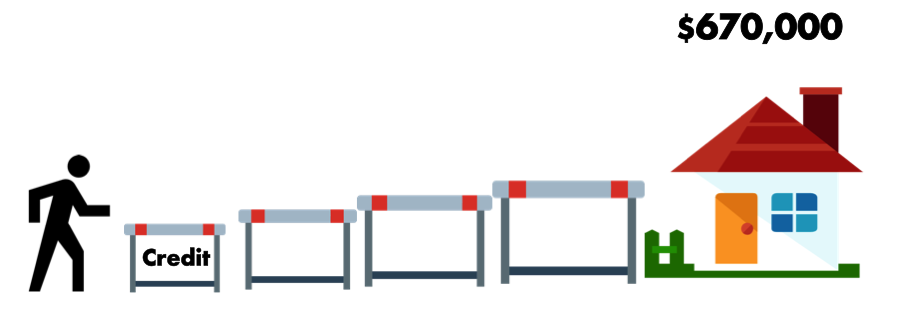

Ep.1 - The First Hurdle to Homeownership in LA - Credit Score

📸 IG handle: DollarSenseLA

If you are seriously thinking about buying a house in LA, you've landed at the right page. If you are not, you will probably be depressed by what you are about to learn in this 4-part series. Good or bad, you be the judge. Here is everything you need to know before buying your first home in LA!

Nuance time! The term “home” throughout the 4-part series refers to a single-family home. The term "LA" is defined broadly, which includes Santa Monica, Culver City , and etc, which are technically not part of the municipality. With the nuances out of the way, let's get straight to the point. A good credit score is the first hurdle for millennials in LA.

Hurdle #1: Credit Score - 740 and Above is Ideal, Anything Below Will Cost You

Your credit score is crucial in buying a house because it determines your interest rate on a mortgage loan. If you are like most millennials I know, you can’t afford to pay all cash on a house. Similar to buying a car, since you don't have all the cash, you need to borrow from a lender. Based on your credit score, the lender makes two decisions: 1) underwriting (whether or not to give you a loan) , and 2) pricing (if offered a loan, what would be the interest rate).

The better your credit score is, the lower mortgage interest rate you will get. In the world of residential mortgage, interest rates are offered at an increment of 0.125 pt. For example, if a #lonewolf has a good enough score that gets him the best rate on the market at 3.5%. The next best rates are 3.625%, 3.75%, 3.875% and etc. Each 0.125 pt will cost you a bit in your monthly payment. On a typical 30-year fixed loan of $600k in LA, each 0.125 point increase in interest rate roughly translates into an additional $44 in your monthly payment.

After the Federal Reserve hiked rates on March 15th this year, the best interest rate on a 30-year mortgage is now 4.25%, or even higher from many lenders. This is a 3/4 of a point increase from October 2016. On the same $600k mortgage, the same person pays $258 more every month just six months later.

You may be wondering, what is the credit score that can get you the best rate? The answer depends on the mortgage program.

For the average millennial, the two best options for mortgage financing are 30-year fixed conventional loans and FHA loans. Why? Both programs require a much smaller down payment than the traditional 20%. For this reason, these are the only two options I am discussing in my post.

On a conventional 30-year fixed mortgage, you need a minimum credit score of 740 to secure the best rate. It doesn’t make a difference whether it is 740 or 790. However, if your credit score is lower than 740, you will pay more in the form of a higher interest rate.

How does it work if your credit score is lower than 740 ? Credit scores are bucketed at 20-point increments, such as +740, 720-739, 700-719 and etc. Your interest rate becomes significantly worse if it is under 700 because credit scores and interest rates have an logistical relationship instead of a linear relationship. In layman's terms, assuming 740 means the best market rate of 4.25%, your rate will be 0.25 pts higher at 720, 0.75 pts higher at 700, 1 pt higher at 680, and 2 pts higher at 660. How much does that translate into dollar amount? Check out the chart below by mousing over the bars. You will be paying $88, $269, $361 and $742 more, with each of these four scenarios respectively. My personal opinion is, if your credit score is lower than 700, you should consider the FHA program.

How Much Does Your Credit Score Cost You If You Don't Have the Perfect 740 (mouse over for details)

With the FHA program, you only need a score of 680 to access the best market rate, which is often the same rate or .125% higher than the conventional 30-year fixed rate. However, FHA loans do come with additional costs in other forms. In the later part of this series, I will explain in detail on the two major costs of an FHA loan. For now, let's talk about how an FHA loan can save you money if you don't have the perfect credit score. Assuming the FHA loan is 0.125 pt higher than the market rate, you are charged at 4.375% instead of 4.25%. In dollar terms, it translates to $44 dollars more a month, on a typical $600k loan. Compared to the conventional loan program, on the same 680 credit score and the same $600k loan, FHA saves you over $300 a month.

How Much Money Can an FHA Loan Save You? (mouse over for details)

“On a typical 30-year fixed loan of $600k in LA, each 0.125 point increase in interest rate roughly translates into an additional $44 in your monthly payment. ”

What’s Next?

A good credit score can save you hundreds of dollars a month on a mortgage. Yet a good credit score is likely the least challenging hurdle for all groups of millennials: #young&free, #young&hitched, #lonewolf, #hustlecouple.

If you want to learn what is the minimum income you need in order to buy a home in LA, stay tuned for the next episode.