Ep.4 - The Last Hurdle to Homeownership in LA – DTI Ratio

Hurdle #4: DTI Ratios - CAUTION! This May Be the Death of Your Homeownership Dream

📸 IG handle: DollarSenseLA

“As a rule of thumb, every $600 of monthly debt translates into $100,000 more in the house price you could afford.”

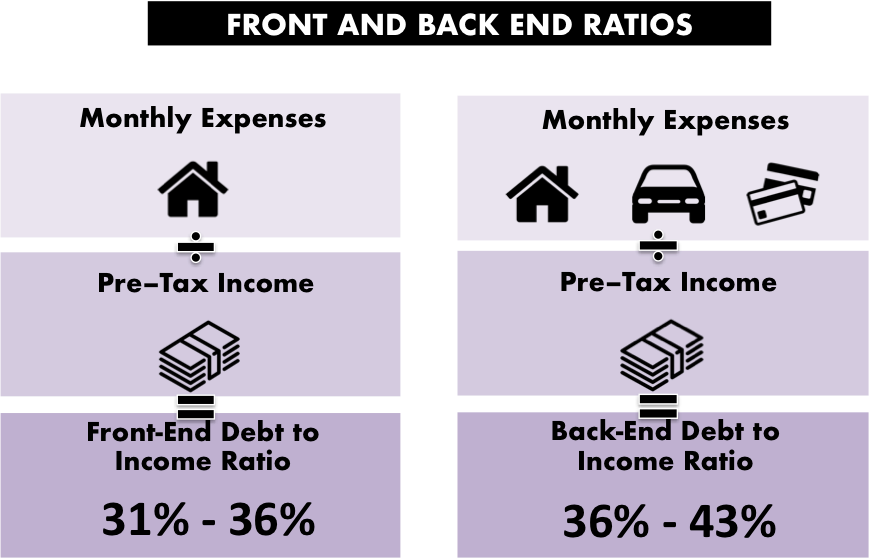

So far, we've covered credit scores, income and down payment. The impact of all these variables come together in the form of two numbers: Front-End Debt to Income (DTI) ratio, and Back-End Debt to Income (DTI) ratio.

Front – End Debt to Income Ratio compares your total monthly housing costs (principal, interest, property tax, homeowner insurance and PMI) to your total monthly pre-tax income. The traditional guideline has been 28%. In the current market, you can easily find a lender who is wiling to stretch that to somewhere between 31% and 36%. In my opinion, this is less of a problem than the back-end debt to income ratio, as most lenders have some wiggle room.

Back – End Debt to Income Ratio compares your total monthly housing costs, AND all your other debts (car payments, student debt, alimony, revolving credit card debt and ect) to your total monthly pre-tax income. The traditional guideline had been 36%. However, in my personal experience, lenders can make it work all the way up to 43%, but much harder beyond 43%.

In certain cases, you may find lenders who are willing to approve you even with 50%. Let me give you my two cents on 50% DTI ratio. After all the taxes (assume 30%), 401k savings (assume 6%), and servicing your all of your debts (50%), you will have only 14% left. Just because someone is willing to lend to you, does not mean you can afford it. The last recession proved it to us all.

If you are a millennial in LA, you probably have a student loan and a car payment, (lease or car loan both matter). Having any outstanding debt will dramatically limit your ability to buy a home in LA. How? You need to make more money in order to meet the debt to income ratio requirement, otherwise you need to look for a cheaper house.

As a rule of thumb, every $600 of monthly debt translates into $100,000 more in the house price you could afford. What does it mean? Let's assuming you are pre-approved for a $600k house and you have to pay $600 towards debt every month. if you can get rid of that debt, you then can buy a house up to $700k.

Let’s also consider four likley scenarios with two types of buyers, on two types of loans on the same house. The first couple, Rich and Debbie, have no debt. Alternatively, the second couple, Freddy and Fannie, have a monthly car payment of $300 and student loan payment of $280.

The illustration below shows the income range each couple needs in each scenario. I marked the low-end and high-end within the range, because different lenders will exercise discretions to decide their debt to income ratio. In other words, you should definitely shop around.

Here are my four takeaways.

1. $120K is really the minimum you need to make in order to buy a house worth $670k

If you use FHA, or you have any debt, you need to be prepared to have an income closer to $150k. If you come short, you should pivot to houses that are closer to $600k.

2. You really need to be in a dual-income household in order to afford a house

Good news for #young&hitched and #hustlecouple. But if you are single, you either need to make a lot of money in finance or tech and/or borrow from family.

3. If you have the typical car/student debt, you need to make at least $15k more than your peers who do not have any debt

When both couples are buying the same $670 house with a conventional loan, Rich and Debbie need a minimum income of $113k, whereas Freddie and Fannie need to make $130k.

4. Pay off your car and student loan first, if you have the means

You should really consider paying off your student loan first, even if you meet the income requirements. Paying off other debt will prevent you from stretching too thin and save on the interests on your student loan and auto loan.

Final Thoughts:

If you are a millennial (most likely a #hustlecouple) who has a strong desire to buy a home in Los Angeles, and you meet the criteria described above, you should be confident to shop for homes in the range of $600k and $670k in the following areas: West Adams, Leimert Park, Jefferson Park, Windsor Hills, View Park, View Heights, and Morningside Park in Inglewood.