Ep.36 - Adulting101 - How to Invest Your First $1,000 in Stocks (3 Minute Read)

Read Time: 3 Minutes

Investing in stocks is the the most common way of growing your money. Unfortunately, it's never taught in school. This article is a crash course on everything you need to know on how to invest your first $1,000 in stocks.

HOW TO MAKE MONEY IN STOCKS

Buy low, sell high. That's it. That's the game you're playing. Almost everyone understands the "buy low" part, because that's how we behave when it comes to shopping for almost everything in life.

However, the "sell high" part gets lost for many. You don't make money by buying low and doing nothing. Seeing your stocks growing on paper is called "unrealized gains." Remember, it's not real, until you sell it.

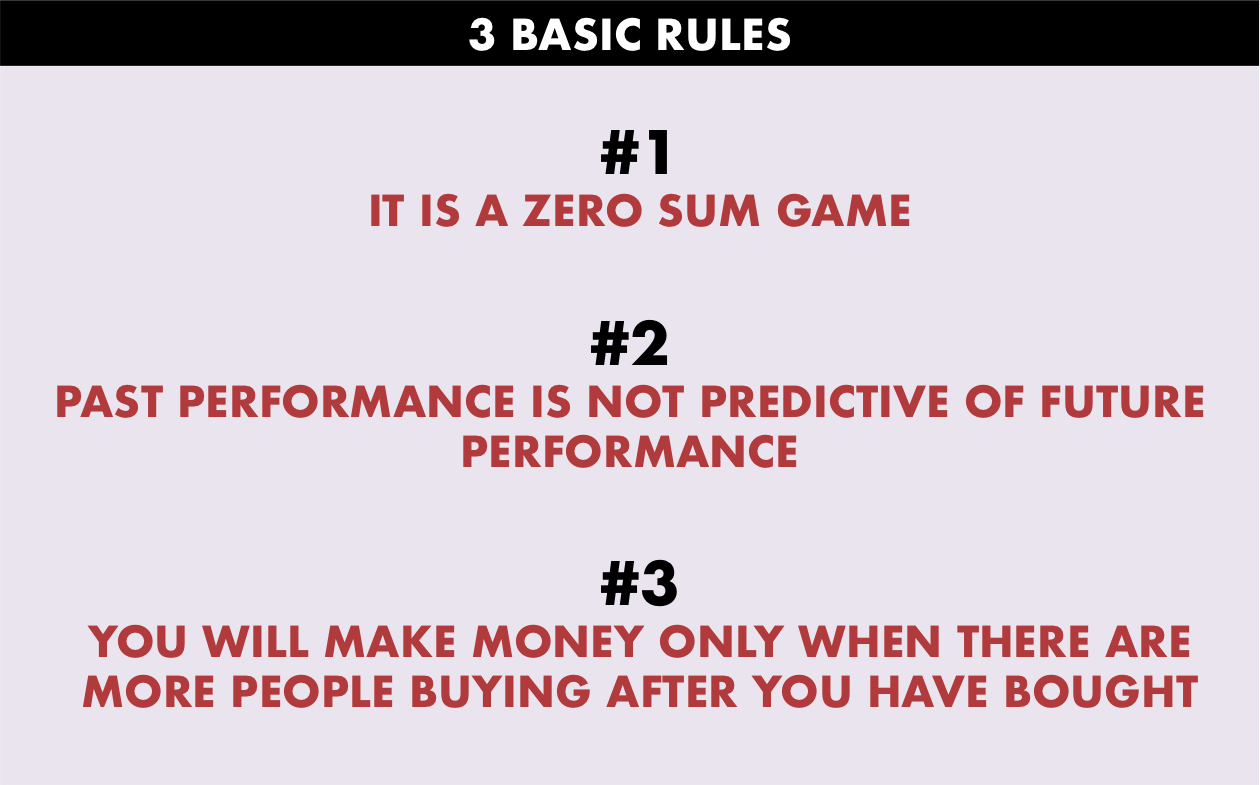

There are three basic rules of stock investments you need to understand.

RULE #1: STOCK INVESTMENT IS A ZERO SUM GAME

Investing in stocks is a zero sum game. It is similar to playing poker. When you make a dollar, someone else in the world has to lose a dollar. The advice is: you need to anticipate what others would do, and act a step ahead.

RULE #2: PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE PERFORMANCE

This rule holds true for stocks, as well as professionals who give advice on stocks.

In terms of stocks, just because a stock performed well in the past, it does not necessarily mean it will continue to perform well. The advice is: don't buy stocks just because the price has been growing. That's not enough reason to believe that upward trend will continue. The point is you should do additional research.

In terms of the professionals who manage stocks, this rule is also true. Simply put, if John Doe tells you he's made so much money in stocks last year, don't believe that he can replicate his success next year. The advice is: you can take professional advice, but it's not enough, as you still need to do your own research.

RULE #3: UNDERSTAND WHAT MAKES THE PRICE GO UP/DOWN

You have to understand how the price of a stock goes up or down mechanically and theoretically.

Mechanically, the price of a stock goes up when there are more people buying than selling. It goes down when more people sell. For example, if you buy the Snap stock at $15 today, you will make money only when there are people buying the stock AFTER you. If no one buys after you, the price will not go up. It becomes somewhat of a psychological game.

Theoretically, the price of a stock reflects the current cash flow and all future cash flows discounted to the present value. That's a mouthful. In layman's terms, it means the price of a stock reflects everything we know about the company at that point, and only NEW INFORMATION can change the price, by directly changing people's expectation of the company, indirectly causing people to buy or sell the stock. Below is an example.

For example, when the VP of business development at Tesla left the company in September 2017, it sent a signal of internal trouble, which negatively impacted a lot of people's expectation of Tesla's future. As a result, a lot of people started selling the stock, which caused the price to go down.

WHICH PLATFORM SHOULD YOU CHOOSE?

A platform is a tool where you can buy and sell stocks. Just like Youtube is a platform for uploading and consuming videos.

Personally, I recommend Scottrade and Robinhood (not sponsored). I recommend Scottrade, because I've personally used it for the past 6 years. It's been excellent. The cost is $7 per trade (buy or sell). Not too bad.

I also recommend Robinhood, because it costs nothing to execute a trade. If you are just learning how to invest with $1,000, $7 is a lot taken out for every trade. For that reason, I think you should try out Robinhood, although I have not used it personally.

WHERE TO DO YOUR RESEARCH

News: New information is what drives the change in stock prices. Read news about whatever stock you are interested in. You can just Google search for the most part. As mentioned above, information drives people's expectation, which causes the stock to rise or fall.

Google Finance: It's a great tool to track trends of one or multiple stocks.

WHAT'S MY RECOMMENDATION

I am not an expert in predicting the stock market. No one is. The easiest place to start is to invest in a well-diversified ETF , such as SPY , as it tracks the performance of S&P 500. In other words, if the entire stock market is moving up, you will make money.

Here is a simple analogy. An ETF is a basket of stocks, just like a basket of foods, which contains fruits, veggies, meats, etc. SPY is one specific example, representing all the foods in the world. When it comes to eating, it is healthier to eat a diverse basket of foods, instead of only chicken. The same is true for investing. It is less risky when you invest in a basket of stocks via an ETF, instead of one individual stock

WHAT TO DO WHEN YOU LOSE MONEY

Losing $10 has a much stronger impact to our emotions than gaining $100. If you see your stock value is going down, don't panic. It's happened to EVERYONE, even the most seasoned professionals. If you don't need to take out the $1,000 for an emergency, I would recommend holding on to it for the long haul, or at least the next 12 months. The chances are, it will probably bounce back if you give it time, unless the company you invest in is entirely going under.

Follow me on Instagram: dollars_and_sense_la.