Ep.91- Does Marriage Really Save You on Taxes? It Depends on Income Disparity

📸 IG handle: DollarSenseLA

DO YOU REALLY SAVE ON TAX AFTER GETTING MARRIED? YES, BUT IT DEPENDS…

Personally I wasn’t clear if people save on income taxes after marriage, until we got married ourselves a few years ago. There are just not that many clear explanations with concrete examples online. As a result, I am sharing my post-marriage tax learnings with 6 examples from 3 income levels, at $60k, $160k and $280k.

The long and the short of it is that, whether you save on taxes or not entirely depends on the income disparity between the couple, not how much the total household amount is. In fact, you get the most tax savings post-marriage, when one person makes drastically more than the other person. However, if both people make the exact same income, there are zero tax savings.

Continue below to see the 6 examples to understand what I meant by it.

WHAT ARE ALL THE TAXES WE PAY?

We pay 4 or 5 different taxes out of our paychecks. They are federal income tax, state income tax, social security tax, medicare tax, and sometimes a state-specific tax, such as the 1% disability tax in California.

ASSUMPTIONS

In all the case studies below, I am assuming the following scenarios, to make it very straightforward.

Wage-earners: Both people work, and both are wage earners, not self-employed.

Standard Deductions: People take the standard deductions when single or married, not itemized.

Year: 2019

No Pre-tax deductions: I am assuming there aren’t any pre-tax deductions such as 401k or HSA contribution, to make it less complex.

No Kids: There are no kids, only the two people in the relationship.

State: California. California not only has the highest state income tax in the country, but also an extra 1% disability tax.

A CASE STUDY OF COMBINED INCOME AT $60K

When the couple makes equal wages, there is absolutely no tax savings after marriage.

On the other hand, if there is a huge income disparity between the couple, the couple will save through federal and California income tax. In this example of a couple making $10k and $50k separately, after marriage, they will save $1,140.

A CASE STUDY OF COMBINED INCOME AT $160K

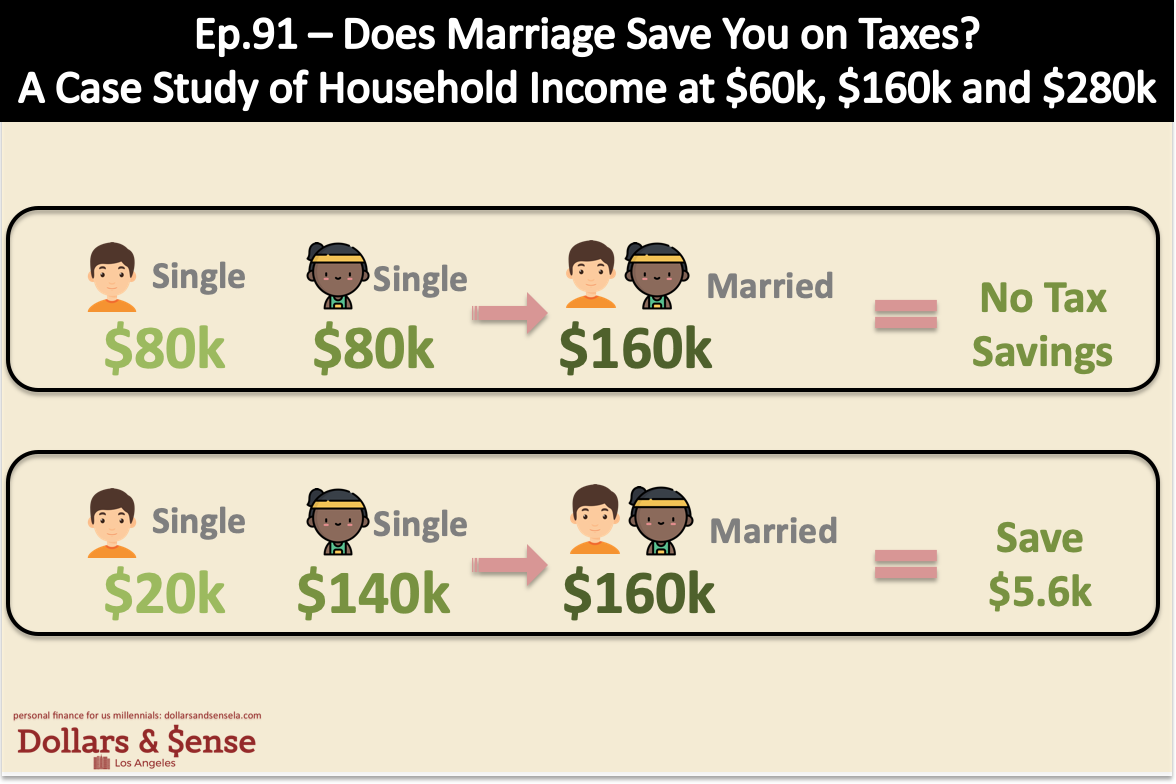

Similar to the case study at $60k, when the couple makes equal wages, there is absolutely no tax savings after marriage at $160k neither.

On the other hand, when one makes $140k whereas the other one makes only $20k, this couple can expect to save $5,600 together after marriage.

A CASE STUDY OF COMBINED INCOME AT $280K

Again, there is no tax savings if both people make the same amount at $140k per person.

On the other hand, when there’s a huge income disparity ($250k and $30k separately), this couple can expect to save $11k together after marriage.

TAKEAWAYS

Marriage will save you on income taxes, if, and only if two people make drastically different wages. The bigger the income disparity is, the more the couple will save together. However, if both people make the same or similar wages, there will be zero or extremely minimal tax savings after marriage.