Ep.57- The Ultimate ROI Calculator of an MBA Degree

Read Time: 5 Minutes.

📸 IG handle: DollarSenseLA

Is an MBA degree worth it for you? It is an age-old question. The short answer is yes, as long as you don't make $185k/yr already.

Why $185k? $185k is the expected salary (base+bonus) for a 1st year management consultant out of a top MBA program in 2018, THE most popular career path, where 1 in 5 MBA students choose.

THE BETTER QUESTION IS NOT "IF", BUT "WHEN"

The better question is to ask is, how long does it take to recoup the investment on an MBA. It really depends on three components of your total investment: opportunity costs, MBA out-of-pocket expenses, and student loan interest.

Opportunity Costs: Your current salary matters a lot because this is your opportunity cost. The earlier you are in your career, the lower your salary is, which means, the shorter it takes you to reach the ROI break-even point, because you had less to give up.

Out-of-Pocket Expenses: The sticker price of an MBA is irrelevant, because most of us don't pay the full amount. Harvard Business School (HBS) lays it out very clearly that the ways of funding an MBA are scholarships, savings and student loans. Scholarship is free money from the college. What matters is the amount you ACTUALLY have to pay, which is either in the forms of savings or student loans.

Student Loan Interest: This is a relatively small component of your total costs. Typically it's around 7% for 10 years. But most people pay it off early to save on interest payments.

THE TRADITIONAL WAY TO CALCULATE AN MBA'S WORTH

Traditionally, the metric people often use to calculate the worth an MBA program, is salary to debt ratio. For example, if you make $150,000 after the MBA program and have $100,000 in debt, your ratio would be 1.5. It's a quick and dirty way of evaluating different MBA programs, but extremely imperfect. For illustration purposes, below is an example of Harvard Business School, published by US News.

This method is imperfect for many reasons. Here are the 3 biggest issues.

You don't use pre-tax dollar to pay student loan: For a true ROI calculation, we would need to convert pre-tax salary to take-home.

Everyone's opportunity cost is different: If the expected income is $185k, it's much more advantages for a person who currently earns $60k, instead of $160k to get an MBA.

U.S News' starting salary does not include bonus: Bonus is a big part of the total package, the US News does not take into account.

THE BETTER WAY TO CALCULATE AN MBA'S WORTH

To help myself make the best decision possible, I built my own calculator, which takes the followings into account.The output is the number of years it takes for you to reach your break-even point.

Convert pre-tax salary to take-home pay

Pre-MBA salary

Signing bonus

Student loan interest

Early repayment of student loans

Full salary with bonus after an MBA.

Click on the calculator (the button) to plug in your own numbers. Read on for further instructions.

Please note this isn't a perfect calculator as I am making a few assumptions which may not be true for everyone. It is especially difficult to predict one's salary after 5 years. Nonetheless, this one is much more accurate than anything else I've seen on the Internet.

HOW TO USE THE CALCULATOR

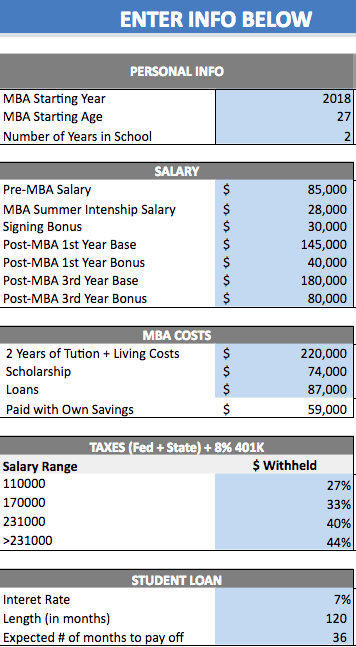

Click on the button "RYAN'S MBA CALCULATOR". Enter all the info in the cells that are highlighted in blue. That is it.

AN AVERAGE HARVARD BUSINESS SCHOOL CANDIDATE

For illustration, below is an example with the profile of a typical Harvard MBA student who accepts a job from a top management consulting company after graduation.

Future Income:

This HBS candidate starts the MBA program at the age of 27, and makes $85k/yr before entering the MBA program.

He/she makes $28k during the summer internship.

After graduation, he/she enters a top management consulting company, with a signing bonus of $30k.

In the first year of working a full calendar year (the year after graduation), he/she makes $145k base +$40k bonus, totaling $185K/yr.

After two years, he/she gets promoted to an engagement manager, which increases the total pay to $260k/yr. Other than that, there is a an annual salary increase of 3%.

School Costs:

Based on Harvard Business School site's costs for 2018-2019, the total costs is $220k for 2 years for a person that's single.

With HBS's average scholarship being $74k over the two years, and the average student debt being $87k after the MBA, the candidate is expected to pay for the remainder $59k with existing savings.

In this case, the total out-of pocket costs are $87k + $59k, $146k.

Taxes & Take-Home Pay:

This part is imprecise, as everyone's tax situation is different. But it is still very helpful. I am making an assumption of 8% 401k contribution, on top of federal and state taxes. For example, if someone makes $85k, the take home pay is 73% (100% - 27%). If someone makes $200k, the take home pay is 60% (100%-40%).

Student Loan Interest:

As of May 2018, the typical loan term is 7% for 10 years. But most MBA candidates plan to pay off the debt sooner than 10 years, so he/she can save on interest . In this case, I made an assumption the person plans to pay off the $87k student loan in 3 years (36 months),

HOW TO INTERPRET THE RESULTS - BREAK EVEN AFTER 4 YEARS

This calculator compares the lifetime earning (post-tax) before an MBA and after an MBA. When the post-MBA lifetime earning exceeds pre-MBA, I call it the break-even point.

TOTAL COST: $252K

Total costs are made up of 3 components.

2 years of post-tax foregone income: $125k

Out of pocket school costs: $126k ($87k loan + $39k savings)

Loan interest: $16k (if you pay it off in 3 years instead of 10)

BREAK EVENT POINTS: 4 YEARS AFTER MBA

In the case of our HBS candidate, his/her break event point is 4 years after the MBA program, 6 years since the beginning of his/her program. You can argue, it's not bad at all. It's purely net increase after that. However, this changes dramatically if you receive less scholarship, and/or you make much more than $85k/yr before the program.

More likely than not, the statistical average person from the HBS data doesn't describe you. To get a precise answer, you should scroll up to click on "RYAN'S MBA CALCULATOR" to try it for yourself.