Did you know most Americans are not financially literate? Here are 4 hacks to improve your financial literacy.

Read MorePart of a six-episode series, "Yes. You Can!". Let's explore what your options are if you make $200k a year.

Read MoreYou make a lot of money, so you think you financially secure, right? Well... what if you lose your job today, how long can you last? Take this test to see if you are truly financially secure.

Read MorePart of a six-episode series, "Yes. You Can!". Let's explore what your options are if you make $150k a year. #dsla #personalfinance #losangeles

Read MorePart of a six-episode series, "Yes. You Can!". Yes, you can be a homeowner in Los Angeles, if you make $120k a year. In terms of income, this puts you in the top 10% of the entire U.S.

Read MorePart of a six-episode series, "Yes. You Can!". With $100k a year, you would think it should be easy to afford a home right? It couldn't be further from the truth.

Read MorePart of a six-episode series, "Yes. You Can!". Yes, you can be a homeowner in Los Angeles, if you make $80k a year.

Read MorePart of a six-episode series, "Yes. You Can!". Yes, you can be a homeowner in Los Angeles, if you make $60k a year.

Read MoreI am a strong believer a Harvard MBA is not worth it for 3 reasons, not just because the normal reason on tuition costs you've heard a million times already. I think it's not worth it because it kills entrepreneurship, it takes a decade to recoup the investment, AND you will miss another housing boom.

Read MoreThe LA housing market is booming. But are we close to a peak? Is it too late to buy a house? I don't think so and this is why.

Read MoreIs it worth it going to your college reunion? Well, I just came back from mine. I think it is only worth it if you can correctly answer these two questions, why are you going and can you afford it?

Read MoreDo you want to learn how to fly or stay in hotels for free? YES you can! In this episode, I will break down how you can use a blog called the Points Guy to travel for free!

Read MoreI have become more money savvy over the year partially due to trial and error, but also partially due to the knowledge I gained from this podcast, Money For the Rest of US.

Read MoreIn this episode, I will show you how I control my finances with budgeting.

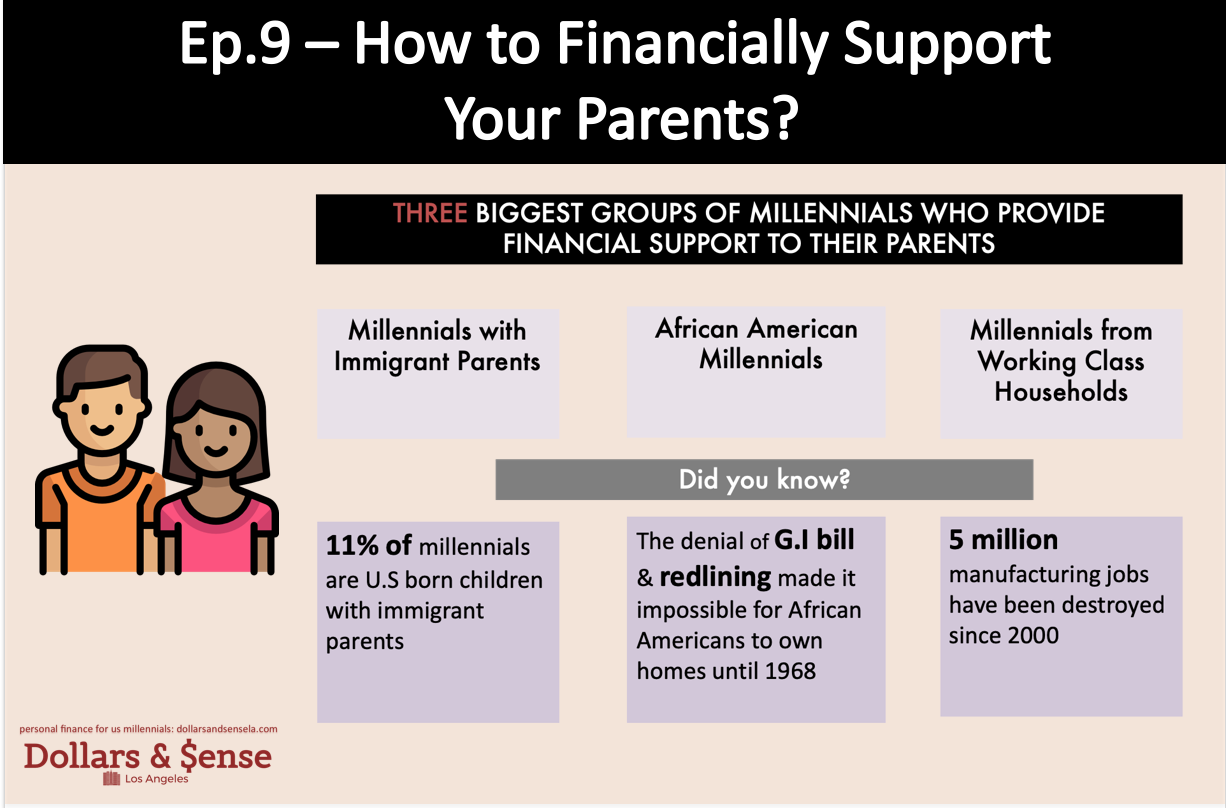

Read MoreAre you stressed over financially supporting your parents? Are you a millennial with immigrants parents? If you are, your situation is more common than you may think. What can you do to deal with the stress? Check out this post.

Read MoreHave you ever thought about money in relation to time? The past, present and future self? Debt, in particular, is a time machine. It creates a temporal shift in your finances between the present self and your future self.

Read MoreThere are many hidden costs and benefits to owning your own house. What are they and how does it stack up compared to renting in LA? We are going to break it down in this episode.

Read MoreThe popular musical "Hamilton" is coming to LA in August. Their tickets went on sale on April 30th ranging from $85 to $650. Just a day later, the cheapest tickets on Stubhub are around $400 and the more expensive ones cost over $3,000. The economics behind this can be summarized in one word - Scalpers. They tend to get a bad rep for driving up prices. But I don't think so. Check out this episode if you want to find out why.

Read MoreDid you know people could buy single family homes in Santa Monica for $600k in 2010? Where can you buy with the same $600k now? In this episode, you will find out where the LA housing market has been and where it is headed in the next 5 years.

Read MoreIn the last part of this 4-part series on homeownership in LA, you will learn how all of your financial situation will combine and convert into one number, the DTI ratio.

Read More