Ep. 83. If you want to protect your new luxury car you just bought with an extended warranty, look no further, Geico’s extended warranty, Mechanical Breakdown Insurance, trumps all others. It is cheaper than all other options by at least 80%. Go straight to Geico. That’s it!

Read MoreEp. 82. It's a great time to refinance your mortgage because interest rates are at a historic low. There are two types of lenders that can help you. The best way to refinance your mortgage fast and with no cost is to go through a lender that will end up selling your loan, not holding it.

Read MoreEp. 81. The 10 things about money you should know before turning 30. It touches housing, student debt, savings, budgeting, retirement planning, traveling, credit monitoring and more!

Read MoreEp. 80. When we talk about being middle class, we can all picture the white picket fence, the family vacation and maybe a pension plan. But this definition is decades old, and not in touch with the current time. With the elimination of pension, changing workplace arrangement, rising college tuition costs, and the insane housing prices, we should attempt to redefine what represents the modern middle class better than the white picket fence, while staying focused with the core principals of stability and respectability.

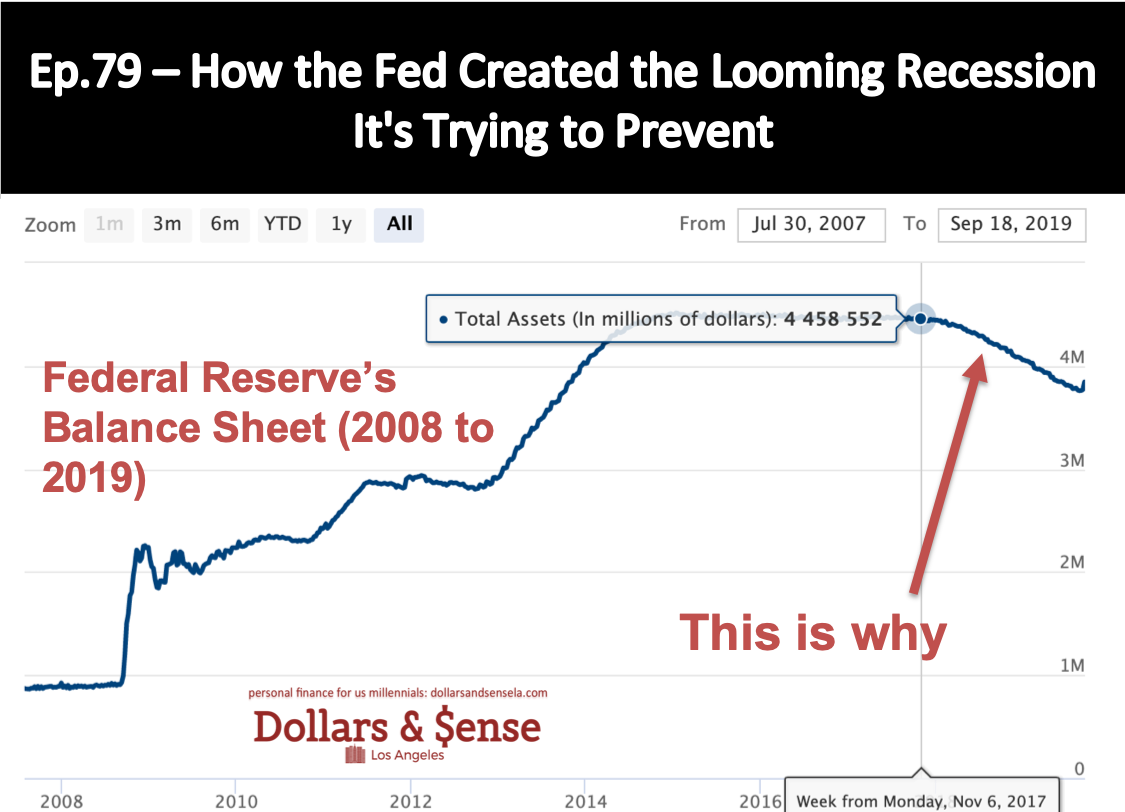

Read MoreEp. 79. Worried about a recession? This article explains why the Federal Reserve is the reason we have a looming recession in the first place.

Read MoreEp. 78. It’s all over the news that that we have an inverted yield curve. It means people are already preparing for a storm, and it’s putting the Federal Reserve at a cross road between a stock recession and a housing bubble.

Read MoreEp. 77. We are in a tech bubble, and it is likely to pop in the next 2-3 years, because, as VC money is drying up, all the unprofitable companies have nowhere to turn, but an IPO. It will be their blessing in the short term, but doomsday in the end.

Read MoreEp. 76. iMarketslive (IML) is a modern day pyramid scheme that thrives on social media, and preys on our FOMO behavior.

Read MoreEp. 75. Your optimal retirement strategy depends on your income. But first you need to know what are 401k, IRA, Roth IRA and regular investment. In this article, you will find out which ones are for you.

Read MoreIf you are doing your taxes with itemized deductions right now, you probably realized you owe a lot of taxes for some reason. You are not alone. It’s most like due to one fo these 4 reasons: SALT, Personal Exemption, Mortgage Interest Cap, and Bad HR.

Read MoreIf you are doing your taxes right now, you probably realized you owe taxes for some reason. You are not alone. Most Americans have been screwed by the tax code change. Episode 73 explains, why standard deduction filers, owe taxes right now. In a nutshell, personal exemption and bad HR.

Read MoreWant to have control over your finances? Dollars & Sense LA has the perfect the budget tool to help you with it (5 min read)

Read MoreEvery year, we see free phone deals on Black Friday, well into the Holiday season. Did you know, it’s never a good deal to get the “free” phone, unless you actually need to add people to your plan? (5 min read)

Read More5 Reasons The Bord Room is my favorite barbershop in L.A. You can also find an exclusive 20% discount code in the article. (5 min read)

Read MoreCoffee shops are a great place for people to do work in. Here are the best $5 coffee shops that are perfect to spend hours on your computers. (5 min read)

Read MoreWant to buy a bird scooter? Here’s how much it costs and where to buy it (5 min read)

Read MoreEntrepreneur lessons from how Ron Shaich built Panera Bread (5 min read)

Read MoreWhat’s The “job” of Working, in the mindset of “Jobs to be Done”? (5 min read)

Read MoreAre You Ready to Buy an Investment Property? Use This 5 Question Checklist to Gauge Your Readiness.(5 min read)

Read MoreThe ins an outs of buying a rental property in L.A (5 min read)

Read More